28+ Loan and mortgage calculator

In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. People typically move homes or refinance about every 5 to 7 years.

Business Planning Checklist Templates 9 Free Docs Xlsx Pdf Checklist Template Business Checklist Planning Checklist

You can also use the calculator on top to estimate extra payments you make once a year.

. If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and see what your current or future balance will be. Veteran Affairs VA loan calculator. Different terms fees or other loan amounts might result in different comparison rates.

With links to articles for more information. Annual real estate taxes. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency.

These are also the basic components of a mortgage. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. Mortgage Closing Date - also called the loan origination date or start date.

Brets mortgageloan amortization schedule calculator. Get answers to some basic home affordability questions. In other words there are no surprises for consumers who know exactly what their monthly home mortgage payments and vehicle loan obligations will be.

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. If a person. 30-Year Fixed Mortgage Principal Loan Amount.

The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan. A mortgage usually includes the following key components. Use a mortgage calculator to see how various loan terms impact your monthly payment the amount of interest youll pay and the total cost of the home.

285 to 32. By working out your estimated loan amount monthly repayments and upfront costs you can enjoy the confidence of knowing what you can afford. Found on the Set Dates or XPmts tab.

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. Weve made it easy for you to better understand your finances with our handy home loan calculator. Almost any data field on this form may be calculated.

Federal Housing Administration FHA loan calculator. Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff. Compare 4000 loans from 28 lenders.

This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. First Payment Due - due date for the first payment. Contact a mortgage loan officer to learn more about these important pieces of the homebuying journey.

Years to Pay. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment. Compare 4000 loans from 28 lenders.

Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff. To qualify for the loan your front-end and back-end DTI ratios must be within the 2836 DTI limit calculator factors in homeownership costs together with your other debts. Home Loan comparison rates are based on a loan of 150000 for a term of 25 years repaid monthly.

See the results below. Calculate loan payment payoff time balloon interest rate even negative amortizations. Compound Interest Present Value.

These comparison rates are true only for the examples given and may not include all fees and charges. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then. Remember a longer loan term means lower.

See How Finance Works for the mortgage formula. Mortgages are how most people are able to own homes in the US. This calculator shows your monthly payment on a mortgage.

Build home equity much faster. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

Explore other calculators for specific mortgage loan types. Your mortgage can require. Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000.

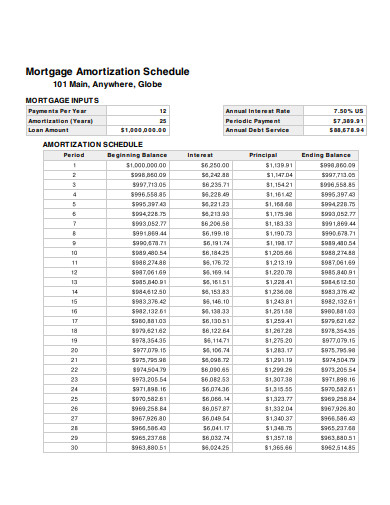

Tables To Calculate Loan Amortization Schedule Free Business Templates

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

0 Old Highway 50a Tract 1 Columbia Tn 38401 For Sale Mls 2429613 Re Max

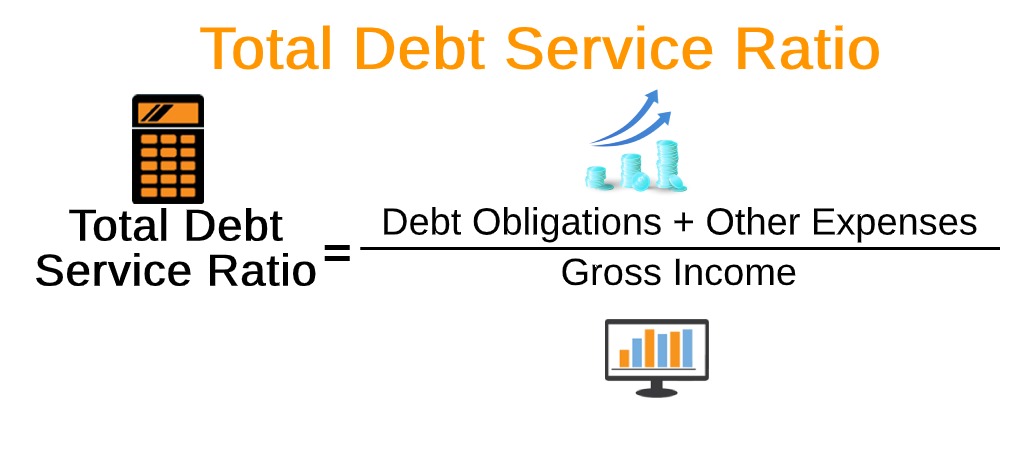

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

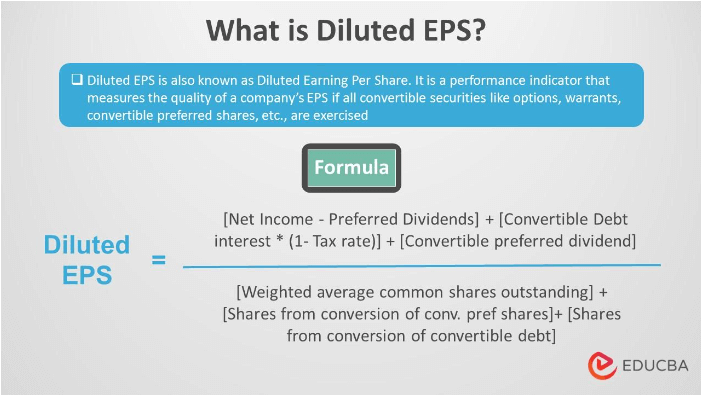

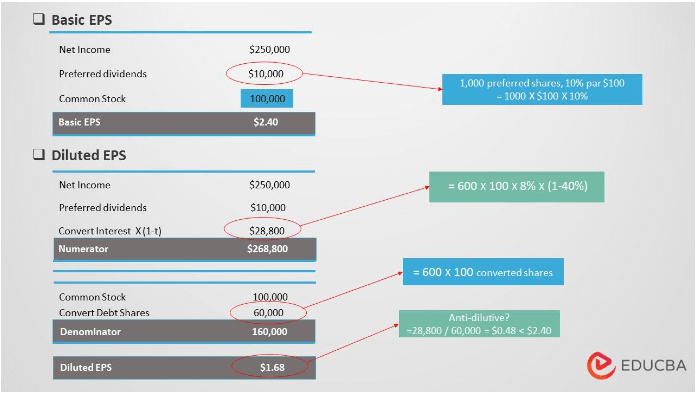

Diluted Eps Earnings Per Share Meaning Formula Examples

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Tables To Calculate Loan Amortization Schedule Free Business Templates

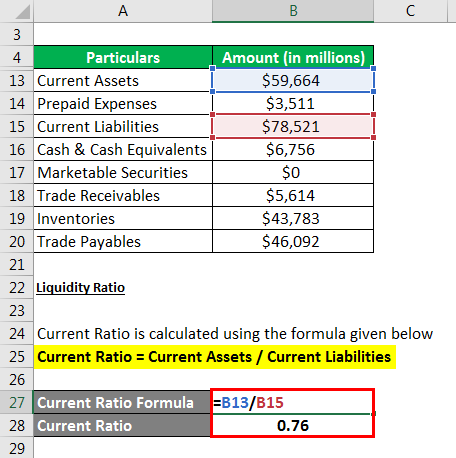

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Tables To Calculate Loan Amortization Schedule Free Business Templates

Diluted Eps Earnings Per Share Meaning Formula Examples

Coding For Kids Coding Preschool Lessons

45 Best Startup Budget Templates Free Business Legal Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Wisconsin Appraisal Continuing Education License Renewal Mckissock Learning

Pin On T I P S I D E A S

45 Best Startup Budget Templates Free Business Legal Templates